Planning for Business Success

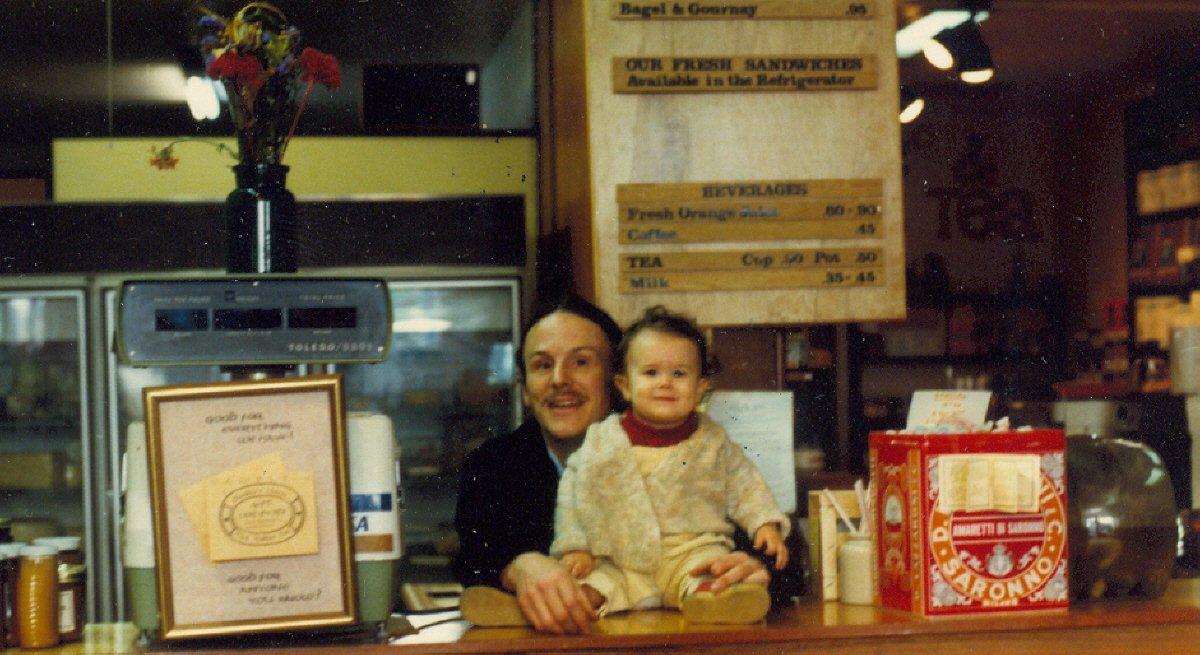

Many people start small businesses and many seem to fail. Risks always exist in business.

You can reduce those risks if you set aside time to plan in advance. This means defining your business offerings, doing specific market research, recognizing the essential management skills you need, and projecting realistic financial expectations… in short, you can reduce risks when you write and use a business plan.

Small business owners often say they don’t have time to write a business plan. There is too much to do and they want to get on with running the business. (Or, they may be intimidated by the planning process or simply be procrastinating.)

It’s true that some small businesses start without planning and do very well. However, once a business is launched and things get complicated, it can be confusing to figure out next steps. A good business plan helps sort out your options and can help you focus.

Business experts disagree about the importance of writing a business plan. Though some research has found that writing a plan greatly increases the chances that a person actually goes into business, there are business school professors out there, like Steve Blank, who say that real entrepreneurs don’t write business plans.

Although it may not sound like it, I actually agree with Blank’s approach. In his Lean LaunchPad classes, he’s pushing students to constantly talk to people and test their theories as they plan. A hands-on, real world approach is central to how I teach entrepreneurship, too. You cannot write a business plan in a vacuum and expect it to serve you well. You must get out there, connect with people, and constantly test your assumptions.

Writing, implementing and maintaining a business plan is hard work. Planning means learning to take the pulse of your business — over and over again. You have to be open to new ideas and be willing to learn from your mistakes. There is a reward for all that hard work, though. You end up with an operational management tool, a marketing plan, financial projections, and a means of communicating your business to others.

The primary purpose for writing a plan, though, is for the process itself. It forces you to be objective and critical, identifying weaknesses, challenges and opportunities and setting benchmarks to track progress. Doing research, talking to people, and analyzing your operation will give you confidence to continue with the business.

It’s really important that the plan reflects your unique owner perspective. The plan is a foundation from which each owner’s business judgment, personal feelings and intuition are measured. You should write it in such a way that you can use it, in a format that is easy to update. To be truly useful, a business plan should be a dynamic document — current, accessible and appropriate for the business. Don’t spend a lot of time making a pretty document unless a formal plan is needed to present to a bank or other investor. It doesn’t have to be perfect looking; the key is that it is useful for you and your business.

A business plan doesn’t guarantee success but it can help prevent serious mistakes. It is a great way to stay attentive to the important details of your business, to industry trends and competitors, and to new directions and business growth. A good business plan will help you maintain profitability, acknowledge and minimize potential risks, and develop confidence for future opportunities.

So how do you find the time to write a business plan? As Tim Berry says, “You don’t. You are always planning. Your plan is never done but your planning process is your key to good management.”

So, write that plan (or revisit your old one). It will be well worth your effort!

Jane and her business partners provide a full range of urban design services, including strategy, design, conceptual architecture, and urban design education and communications.

Jane and her business partners provide a full range of urban design services, including strategy, design, conceptual architecture, and urban design education and communications. Shamita and her business partners co-own a counseling business that provides therapeutic support services to teens and families experiencing emotional, behavioral and substance-related difficulties.

Shamita and her business partners co-own a counseling business that provides therapeutic support services to teens and families experiencing emotional, behavioral and substance-related difficulties.